Mortgage so you’re able to Valuation Ratio (LVR)

The low Put Payment (LDF) is actually a single-out of number payable by you, to the the low put getting repaid on your part and you will/or even the lower number of security you have on your protection assets. The fresh new LDF allows us to to recuperate some of the potential losings that we get come across if you cannot pay your home mortgage. Understand the Reduced Deposit Fee Fact Layer for additional information.

Stamp obligation

Stamp obligation try an income tax levied from the all of the Australian states and you will areas into acquisition of property. The level of stamp duty differs of the condition or territory and you may lies in the house or property purchase price, venue and you can possessions objective.

Interest rate

The home financing interest is the actual price from which interest was energized on your own mortgage and you may doesn’t become charge. Mortgage loan are repaired otherwise variable.

Evaluation rate

The house mortgage analysis price are a performance that assists your workout the genuine price of a loan and you may enables you examine prices amongst other loan providers. Shown due to the fact a share, it gives the rate many of your costs and you will fees per that loan.

When deciding on home financing, you should consider this new analysis rates as well as loan enjoys or also offers which may meet your needs.

Appeal just mortgage

A destination just financing happens when the new debtor merely pays desire, yet not the principal (amount borrowed), to own an assented months (around 5 years). If the desire just period finishes, the fresh debtor begins to spend principal and you may focus on mortgage matter. This means costs increases to pay for dominating. Borrowers exactly who like to have an interest merely months fundamentally spend moreover the life span of their mortgage.

Prominent and desire mortgage

Very lenders try prominent and you can notice financing, and therefore typical costs will certainly reduce the primary (loan amount) together with repaying the attention.

Fixed rate financial

Repaired rates lenders are interested rate which is repaired to own a flat period of time (usually that 5 years). At the end of the newest repaired price name, the borrowed funds will always switch to a changeable rates.

Adjustable home loan

Adjustable rates mortgage brokers have an interest speed that may disperse upwards or off predicated on ount of great interest you pay.

Split up financial

You could choose to have some of your house mortgage on a predetermined speed and several of your home loan at the a good adjustable rates.

- Financial having varying speed

- Mortgage which have fixed rate

- Split up financial with repaired and adjustable accounts.

Basic Home owner Offer

The first Homeowner Offer is a one-of percentage to aid very first home owners create the expenses from to get otherwise strengthening a house. The importance and you may qualification criteria of one’s grant varies based which county otherwise area the house or property is found in. Inside combined applications, each other people must be permitted have the grant.

Family vow otherwise household members be certain that

A family group vow or nearest and dearest ensure happens when a relative acts as guarantor and you can uses a portion of their house’s collateral so you’re able to safer a mortgage. Macquarie Financial will not provide a family pledge otherwise family verify loan.

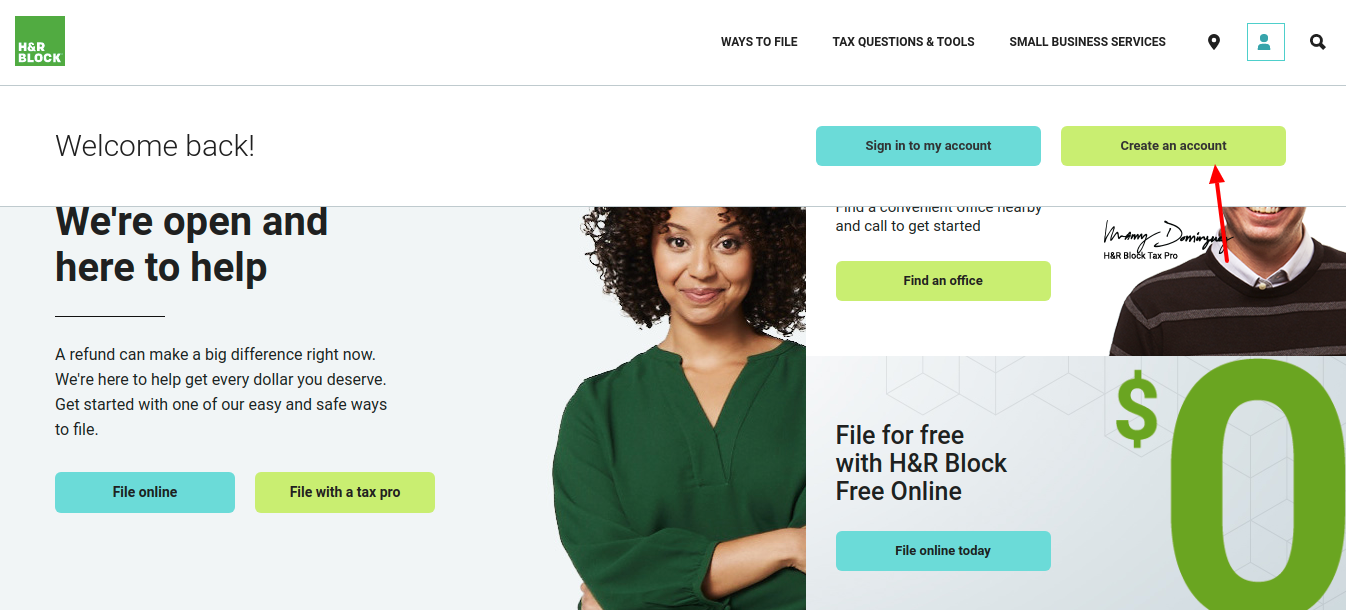

Sign up for a mortgage

- Find the mortgage that’s true for you

- Digital ID to suit your Macquarie Representative home loan application

- Taking home loan documents seen or certified

Begin a real time talk

Log on to Macquarie On the internet Financial and/or Macquarie Mobile Financial application and you can speak to a consultant instantly, Friday so you’re able to Monday, 9am so you’re able to 5pm Quarterly report time (leaving out social vacations).

Experience monetary difficulties?

Please be connected as soon as possible so we is also work together to discover the correct solution for you.

Care for an ailment

Group during the Macquarie was invested in delivering our very own members to the highest degree of products and services readily available. For those who have viewpoints we would like one to write to us about any of it.

- Macquarie Classification

- Private

- Company

Except if stated or even, this post is provided with Macquarie Lender Minimal AFSL and Australian Borrowing Licence 237502 (MBL) and does not make up the objectives, finances otherwise need. You have to know be it befitting your Trail Side micro loan. Finance was at the mercy of our very own borrowing from the bank approval conditions. Small print pertain and may also changes without warning.

Apple Spend, the new Apple image & iphone try trademarks from Apple Inc, joined regarding the You.S. or other places. Software Shop are a service mark out of Apple Inc. Android Shell out, the latest Android os Representation and you may Yahoo Enjoy try trademarks regarding Yahoo Inc. Mastercard and the Charge card Brand mark try joined trademarks of Charge card Worldwide Incorporated. BPAY are an authorized signature out of BPAY Pty Ltd ABN 69 079 137 518.

Aside from MBL, none of your own Macquarie Category agencies described was authorised put-delivering institutions into purposes of brand new Banking Work 1959 (Cth), except if detailed otherwise. The loans do not show dumps or any other liabilities from MBL. Except if if you don’t said, MBL cannot make certain or else give assurance in respect from the brand new obligations of these entity.