Contents

With this specific mortgage system, you could potentially improve your current conventional otherwise Virtual assistant financing with good the newest Va loan and become your home’s remaining guarantee toward cash. Following, you can utilize the money for purpose, eg debt consolidating or renovations.

Of the refinancing, you can purchase a new Va mortgage having $3 hundred,000 to pay off your existing mortgage and take $75,000 from inside the dollars.

The degree of dollars you could potentially take out utilizes several things, like the property value your home, your a great financial balance, the fresh closing costs, together with lender’s procedures.

In this article, I will definition the application form criteria and feature you how it works to help you decide if brand new Va bucks-aside home mortgage refinance loan suits you.

What exactly is an effective Va cash-away re-finance?

A great Virtual assistant bucks-out refinance loan try a mortgage protected from the U.S. Agency away from Pros Affairs (VA) for military experts, productive obligations provider players, as well as their spouses.

It allows that refinance your existing Virtual assistant or low-Virtual assistant mortgage and you may make use of the equity you have built up from inside the your property. You might typically take-out that loan all the way to 100% of property value your home minus any a fantastic mortgage harmony and closing costs.

Yet not, the principles are different with regards to the bank, so it’s a good idea to discuss with a few loan providers to discover the best contract. You can find info in regards to the Va-backed cash-away refinance mortgage towards VA’s webpages.

Next example reveals how a good 100% Virtual assistant dollars-away refinance my work: their residence’s value $three hundred,000, your Virtual assistant financing equilibrium was $225,000, along with $75,000 in home equity.

Imagine if we wish to make use of your home’s security to blow out-of high-notice credit card expense. You happen to be qualified to receive a Va financing, your credit score are 680, and also you be important link eligible for new Va bucks-out re-finance.

- $three hundred,000 the brand new Virtual assistant loan amount

- – $225,000 newest Va financing balance

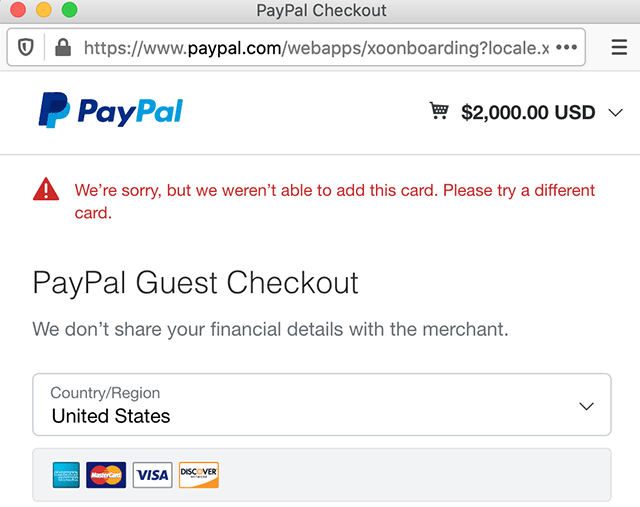

- – $dos,400 estimated settlement costs

- – $10,800 Virtual assistant capital fee

- = $61,800 cash to you at closing

Earliest, subtract the current Va loan harmony and you can closing costs, including the Virtual assistant financial support payment, throughout the new Virtual assistant amount borrowed. Upcoming, you have made $61,800 inside the bucks in the closing to settle the handmade cards.

Once more, this is simply a good example. The Virtual assistant cash-out refinance loan’s certain terms and conditions trust your own lender and your book problem. Have fun with our calculator observe latest interest rates, annual commission pricing (APR), and estimated settlement costs.

- Glance at closing costs, for instance the resource commission. Rating direct advice, which means you understand what you may anticipate when refinancing your house.

Create Va bucks-aside finance want an appraisal?

A good Va dollars-aside home mortgage refinance loan need an appraisal to determine their house’s current worthy of and you will equity and you commonly borrowing from the bank over their residence is value.

The financial institution orders the fresh assessment within the mortgage processes. The fresh new appraiser visits your home, inspects they, and you will prepares a report the lender uses so you’re able to calculate your loan amount.

The worth of your house, just like the determined by the assessment, can differ throughout the price you reduced or what you believe its worth. Nonetheless, the newest appraised worth influences the amount of cash you could need out after you re-finance, so it is smart to features a realistic comprehension of their house’s worthy of before you apply to own a great Va cash-aside refinance.

Are there settlement costs on an excellent Virtual assistant cash-out re-finance?

New Va cash-away home mortgage refinance loan features closing costs, just like any other type off home loan re-finance. Closing costs try charges to afford expenses associated with refinancing your property. Capable will vary according to your own lender plus the certain terms of your own mortgage, it is therefore a good idea to comparison shop and contrast even offers of several lenders for the best price.