- Tricks for People Refinancing their homes Several things to take into account before deciding to help you refinance.

- Can it be Time for you to Re-finance? How you can tell you have the best reputation in order to refinance.

- When Should I Re-finance? Exactly how refinancing at the right time makes it possible to increase collateral and you can shell out straight down rates of interest.

- Home mortgage Refinancing during Bankruptcy Whenever declaring bankruptcy proceeding, refinancing a home mortgage loan is ease your weight.

Residents is also pull security from the house. The newest removed security can be utilized since the a minimal-rates way to obtain company capital, to settle most other high-focus debts, away from money home home improvements. In case the equity was extracted to pay for home solutions otherwise major home improvements the eye debts could be tax-deductible.

People can be reduce course to blow reduced notice along the lives of your own mortgage & very own our home outright faster; lengthen this new duration to lessen monthly payments.

If financial cost decline home owners can also be refinance to reduce their month-to-month financing costs. A-one to help you a couple of % fall in rates of interest can help to save homeowners many dollars when you look at the attention bills more good 30-season loan name.

Consumers who used an arm making very first payments much more afforadable could change so you’re able to a predetermined-price loan when they gathered guarantee & have advanced with each other its community way to enhance their earnings.

Some Federal government-supported mortgage applications such as for example FHA money and you may USDA financing may require ongoing financial top money even with brand new homeowner has generated up generous collateral, whereas a normal loan not any longer expected PMI if the owner features at least 20% security in the home. Of several FHA otherwise USDA borrowers who boost their credit users & money later on change on the a normal mortgage to eradicate the new big month-to-month financial insurance repayments.

Which are the Alternatives to help you Refinancing Your residence?

In lieu of refinancing their home entirely, some property owners that have collected cash america title loans Maine significant equity & already appreciate a low-rate financing can use a house collateral loan otherwise distinct borrowing from the bank so you can faucet their security rather than resetting the rate towards remainder of the current obligations. Property collateral loan are the second home loan and that operates similarly toward first mortgage, but usually charge a slightly high rate. A property guarantee line of credit (HELOC) works similar to a credit card, as the an effective revolving sort of financial obligation and that’s taken through to & paid back as the convenient.

Homeowners: Influence Your home Equity Today

The speed desk listings latest household collateral has the benefit of close by, which you can use discover a neighborhood bank otherwise evaluate facing most other loan choice. In the [loan sort of] come across field you can choose from HELOCs and you may family equity finance from a beneficial 5, ten, 15, 20 or 31 season stage.

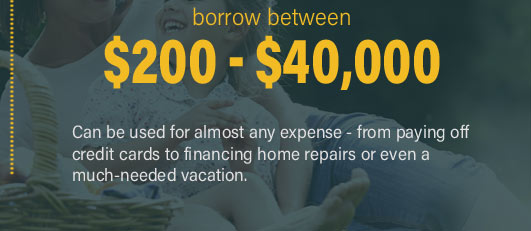

Customers who need a tiny sum of cash to possess an initial time period may want to believe often playing cards otherwise taking out fully a keen unsecured personal loan, in the event these generally speaking charges notably highest interest levels than simply funds protected by admiring property eg next mortgages.

Which are the Risks?

One of the main dangers of refinancing your residence comes from you’ll be able to charges you can also sustain down seriously to paying off your current mortgage with your type of household guarantee credit. In most home loan arrangements there is a provision that allows new mortgage lender so you’re able to charge a fee a fee for this, and they costs can be add up to several thousand dollars. Ahead of finalizing the fresh new arrangement getting refinancing, make certain they covers the penalty and that’s nonetheless convenient.

Collectively this type of exact same traces, discover most costs to understand just before refinancing. Such will cost you become investing in a lawyer to make certain youre obtaining the best bargain it is possible to and you can manage paperwork you could maybe not feel comfortable completing, and you may bank charges. In order to counter otherwise stop entirely these types of financial fees, it is advisable to comparison shop or loose time waiting for lower percentage or 100 % free refinancingpared into the sum of money you may be providing out of your new line of credit, but protecting thousands of dollars in the end is obviously worthwhile considering.