Here are a few type of bad credit lenders you may prefer to research, along with the first conditions you will need to fulfill. Listed here are government-backed loans, definition government entities provides them and you can decreases the chance to own loan providers should your borrower non-payments. This will help lenders promote mortgages to individuals exactly who you’ll otherwise battle so you can be considered.

FHA home loans

Really lenders need borrowers to have a beneficial FICO Rating out-of 580 or higher and you will the absolute minimum 3.5% advance payment for this types of home loan. However loan providers may deal with a beneficial FICO Rating only five hundred for folks who provide a 10% deposit.

Virtual assistant home loans

You don’t have a specific credit rating in order to be eligible for a Virtual assistant financing. But some lenders wanted the absolute minimum FICO Get of at least 580 for this particular loan. Particular loan providers might only work with borrowers who possess an effective FICO Score from 620 or higher. The newest Department of Pros Facts backs these types of funds to have qualified effective-obligations solution users, qualified pros, and you may thriving spouses.

Virtual assistant loans element no down-payment needs, no private home loan insurance requirements, and minimal settlement costs. Yet not, these types of fund perform constantly feature a financing payment.

USDA mortgage brokers

The fresh You.S. Institution from Farming backs USDA money and you may will not enforce at least credit score requirements. Yet lenders that offer these types of financing place her acceptance standards and frequently wanted borrowers to possess Credit ratings of 620 or large so you’re able to be eligible for resource.

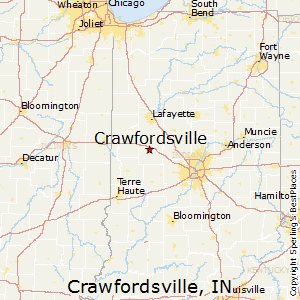

A new brighten from USDA money is the fact there’s absolutely no down-payment needs. Nevertheless must purchase a home in the a qualified rural city-and there is generally a full time income limit, also.

Your credit rating does not only affect your capability to help you be eligible for home financing. It can also impact the rate of interest a loan provider gives you on the financial. Thus, just because you could potentially be eligible for a home loan with poor credit (in a few items) doesn’t invariably indicate it is best.

When you have fair borrowing otherwise bad credit, you’ll be able to same day loan Breckenridge most likely pay a top rate of interest on the house mortgage when you are acknowledged for one. A high rate of interest increases both your payment per month and you may the level of full notice you pay about life of your loan.

Here’s a price regarding simply how much bad credit you are going to probably rates you when the a loan provider energized you a higher rate of interest toward a 30-12 months, fixed-speed home loan away from $350,000 because of a terrible FICO Score:

This type of wide variety mirror a quote made at the time of writing which have a good calculator supplied by FICO. If you want to plug their advice when you look at the and build a more individualized and up-to-date imagine, you need to use the net myFICO Loan Deals Calculator to-do thus.

As you can plainly see on the example above, that have a beneficial FICO Get regarding the lower assortment found from the calculator (620-639) may cost you a supplementary $377 30 days on your own mortgage payment than the some one having an excellent FICO Rating from 760-850 contained in this hypothetical. And you may, over the life of the mortgage, you’d spend on the an additional $135,773 within the focus-just in case you never marketed our home or refinanced the loan-versus a debtor which have an excellent FICO Score.

When you can do so, it makes sense to try and replace your borrowing before you apply to have a mortgage to put yourself regarding the most useful reputation you’ll be able to. But if you need towards the a mortgage in advance of attempting to alter your credit score, the following tips will help replace your odds of qualifying to own bad credit home loans.