For KeyBank personal loans, applying of relationship professionals could be calculated depending whether or not you individual a romance Membership (since the laid out and you will expected over) in the course of final recognition

1. Focus Hit Checking and money Industry Bank account: It Membership will pay attract at the an adjustable interest and you may pricing may differ according to the balance on the Account. We may alter the rate of interest and APY within all of our discernment so when often due to the fact each day. There are not any constraints to your amount your rate of interest or APY could possibly get change. The rate and you may APY for this Account may vary based into the several facts including, although not limited to: your current relationship with the bank once the laid out because of the other Accounts you may have, new balance in all of one’s Accounts, Membership place, Account need or any other financial functions make use of. Your bank account will start to secure desire within Matchmaking rate of interest during the first complete few days of one’s week pursuing the month your meet this type of no credit check loans in Hokes Bluff AL standards. To determine just what most recent Relationship rates of interest and you will APYs are, get hold of your local department.

Immediate Fund: Instantaneous Loans SM . will come in the brand new KeyBank mobile software and can simply appear as the a selection for qualified cellular check dumps. Then there are the possibility getting an elementary put during the no charge. Brand new Instant Fund commission try 2% of your deposit number, having the very least fee out of $dos . Instant Money demands made once p.m. Et can get immediate loans supply to own Atm withdrawal and you can section-of-purchases deals. However, it requires until the next business day on the financing are open to safety overdrafts and other transaction models. To find out more, review our very own Fund Supply Coverage

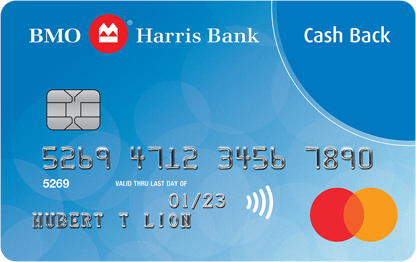

2. Cashback Credit card: As eligible for 2% for the Cashback Benefits, you’ll want a qualified open KeyBank individual family savings (excluding a healthcare checking account) with 5 or higher qualifying purchases printed to that exact same examining account for the a thirty day period. Being qualified deals is, however they are not restricted so you can, section away from sale purchases, costs payment(s), Atm transactions, check, cash, or lead places, and you may digital fund transmits. You may be eligible for 2% with an open qualified Key Personal Checking account. With the 4th working day of each day (“Review Big date”), we’re going to see whether you are permitted earn dos% when you look at the Cashback Perks because of the fulfilling the brand new eligibility standards for the earlier in the day week. Your own dos% income can start on this subject day and implement until your next monthly evaluation (into the last business day of your after the thirty day period). The fresh credit account are certain to get no less than a complete thirty day period on 2% cashback price prior to the very first Review Go out. You are going to discovered a grace several months on the earliest times when you look at the you do not meet with the qualification standards. Unless you meet the eligibility conditions in sophistication period, your own speed on day immediately following brand new elegance months usually feel step 1%, beginning for the Review Time. Cashback Rewards was provided predicated on qualified bank card purchases excluding transactions particularly payday loans of any type, transfers of balance, convenience have a look at purchases, overdraft coverage transfers and you will quasi-bucks deals. Returns will certainly reduce the Cashback Perks harmony. html Trick Cashback Charge card Terms and conditions.

Pick secret/cashback to possess purchase exceptions and extra information, which are at the mercy of change and may be discovered during the trick/personal/credit-cards/key-cashback-terms-criteria

step 3. Personal Credit: The quoted Annual percentage rate (“APR”) has a beneficial 0.25% interest discount having electing, ahead of loan account closing, to obtain the payment per month immediately subtracted off a good KeyBank checking membership (“Auto-Pay”). Standard checking account service fees can get implement. Should you choose not to enroll in Auto-Spend, the latest relevant disregard may not be applied. The car-Pay interest rate discount can be combined with the KeyBank Dating Financial disregard.