Term life insurance are required when taking a home loan regarding UAE. Even though you realize of it, you will pay money for life insurance policies in one method or another when you and obtain a mortgage from the UAE.

Living insurance plan will pay your financial for the matter-of your early passing so that your household members can enjoy the property without worrying from the home loan repayments.

For many finance companies its charged monthly, independent for the loan. Some finance companies increase their interest rate to afford monthly insurance policies advanced and lots of banks can make you pay the rules into the progress.

With Peak Label regulations, the sum covered continues to be the exact same of one’s lifetime of plan and will not disappear given that loan decrease

In the case of maried people, in case the assets and you may financial is just regarding label of the functional spouse; it is not necessary toward non-functioning spouse to acquire https://paydayloanalabama.com/rockville/ life insurance policies but the majority advisors needed at least partial coverage. If for example the mate is on brand new term specific banking institutions insist on every applicants of your own financing are safeguarded aside from that is the amount of money earner.

Most life insurance coverage advisors in addition to strongly recommend Vital Disease Defense (CIC) that will security your mortgage payments to own a time if you should be identified as having a serious problems consequently they are not able to functions.

Term life insurance advanced repayments try a continuous price of mortgaged domestic possession that needs to be factored within your budget. Insurance costs are minimal having an average loan for non-smokers in period of 40. Although not will cost you can increase exponentially along with your age, health in addition to matter insured. Any pre-established diseases lawfully must be shared towards the term life insurance mentor. If you can’t divulge all of them, this is often basis so you’re able to refuse your claim. Definition the ones you love may not get the insurance rates payout once they want to buy extremely.

How old you are, job and you can medical history normally every impact the price of the term life insurance. However, very can also be your country away from origin. Overall the individuals off western places delight in all the way down insurance premium. Even although you hold an american passport, when you yourself have not lived in you to country for more than 10 years, particular insurance rates underwriters will get thought where you enjoys lived for the majority in your life as your country regarding supply.

Insurance premiums can increase somewhat created in the event you are a cigarette smoker. Youre sensed a tobacco user when you yourself have ate any style regarding smoking within the last 1 year. For example cigarettes, cigars, Shisha, electronic cigarettes, gum, and you can spots.

Normally banking companies have their particular during the-house life insurance policy underwritten by biggest in the world insurance organizations. In some instances, providing an outward life insurance policy are going to be most lesser; specifically if you is young and you may compliment. Specific banking companies will allow you to supply your own external insurance coverage. Specific wouldn’t.

Exterior guidelines feel the additional benefit of becoming smartphone; meaning you might import them to a separate property or to a unique bank. Should you become ill afterwards you do not be in a position to safe life insurance policies at a reasonable cost otherwise on the which will prevent you from acquiring a home loan on the UAE. An outward rules secure today if you’re fit might possibly be greatly beneficial subsequently.

Particular UAE banking companies tend to insist on you buying a twenty five year life insurance coverage and you will range from the cost of that it to help you the loan. Although this helps you to save the fresh new monthly insurance costs, it can virtually put 10s & even hundreds of thousands of dirhams to your home loan; immediately lowering your guarantee. Proponents of this type away from pre-paid insurance have a tendency to declare that you are effectively fixing your insurance premiums at the today’s speed nevertheless need think the truth that you’ll shell out interest on this extra amount into life of the loan that makes it much more pricey. Should also your loan maybe not manage the full-term (should you want to sell or desire to re-finance your residence having a unique lender) you will simply discovered a partial reimburse of the pre-paid back policy. In case your financing just last many years this is exactly Extremely expensive.

Believe a twenty five seasons pre-paid down mobile package for which you borrowed currency to pay for twenty five years property value calls in advance…

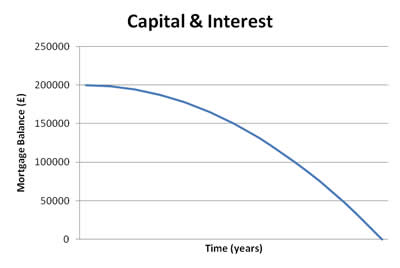

With life insurance the quantity insured decrease over time as your home loan decrease. Speaking of termed as a great Decreasing Identity policy. Given that payable superior continues to be the same, the quantity insured actually decrease just like the financial decreases.

Generally Decreasing Insurance rules are specially readily available for home loan security and tend to be most less expensive than Height Title rules. Whenever you are seeking members of the family safety you should know an even term plan which should be be achieved alone on lifestyle insurance plan with the your mortgage.

Particular will allow you to designate an existing life insurance policy towards the financial provided the quantity covered are enough to payment their mortgage in full

Please note that info is meant for general just use. Life insurance coverage need to be legally applied because of the a licensed life insurance rates mentor immediately after a comprehensive analysis of one’s private needs and you can facts.